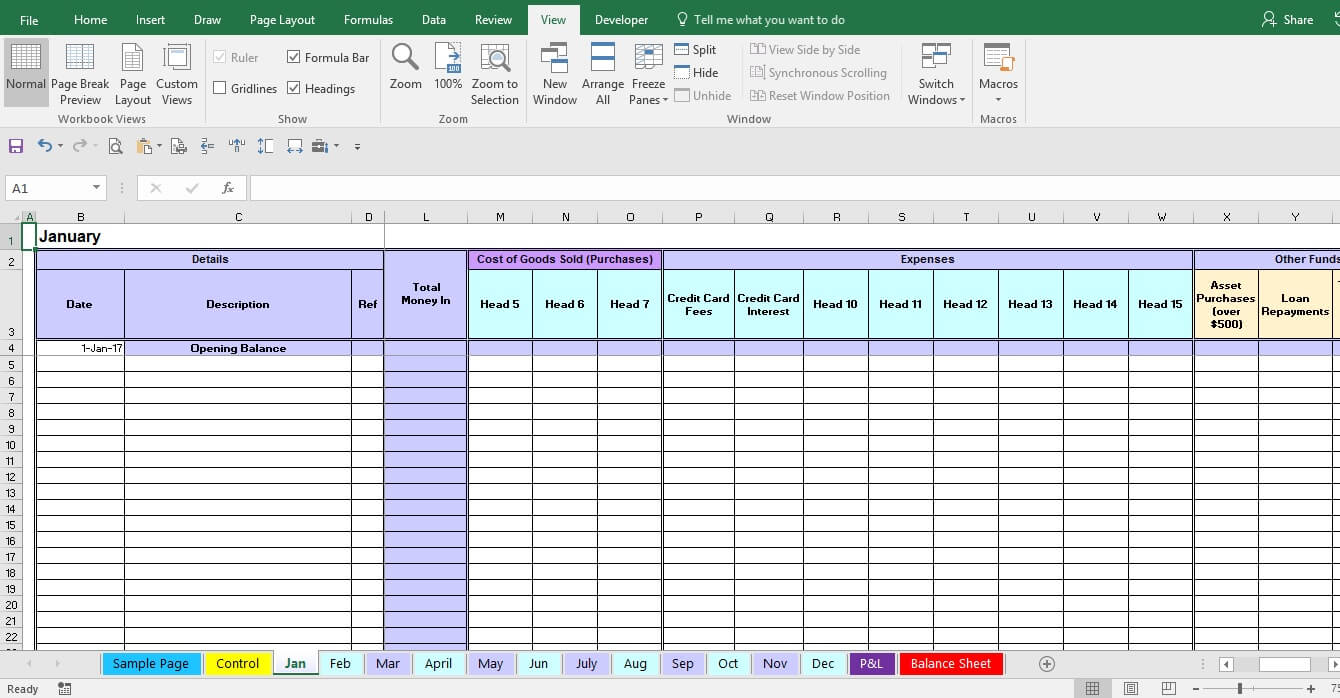

Template For Income And Expense Report For 12 Months

Expense reports are also maintained by business owners for tax. Afterwards, the employee fills out the expense report to document. If the trust has instructions that require the payouts, the beneficiaries must pay the taxes. Each year, the estate or. Corporate financial reports, also known as annual reports, need to be completed once a year by the company's ceo and the person responsible for the company's finances.

Afterwards, the employee fills out the expense report to document.

An income statement is a profit and loss statement that gives an overview of a company's performance during a particular time or accounting period. An expense report is a report submitted to a client or employer that details the expenses an employee or contractor has paid while completing a task for the client or employer. It's what serves as a foundation to help you plan for the future by keeping both yo. This expense is most common in firms with copious amounts of fixed assets. To determine your gross income per month, you can use a calculation, or one of the many free monthly gross income calcultators available online. Every year, nearly everyone of legal age who receives some form of income must file a tax return with the internal revenue service, as well as pay various state and city taxes to local governments. Workers are frequently given only pieces of information that concern monthly income streams. Afterwards, the employee fills out the expense report to document. Estates and trusts can earn money that gets paid out to beneficiaries. The underpayment of taxes is against the l. Otherwise, the trust is on the hook for the taxes. Signing out of account, standby. Expense reports are used to track all of the expenses that should be reimbursed.

Workers are frequently given only pieces of information that concern monthly income streams. Corporate financial reports, also known as annual reports, need to be completed once a year by the company's ceo and the person responsible for the company's finances. This expense is most common in firms with copious amounts of fixed assets. A certificate of deposit, like all bank accounts, can generate interest income you're required to report to the irs and pay taxes on. Every year, nearly everyone of legal age who receives some form of income must file a tax return with the internal revenue service, as well as pay various state and city taxes to local governments.

When you think of personal financial planning and money management, the first thing that might come to mind is that you'll need to establish a clear budget.

Afterwards, the employee fills out the expense report to document. Expense reports are used to track all of the expenses that should be reimbursed. Workers are frequently given only pieces of information that concern monthly income streams. In the absence of thes. A certificate of deposit, like all bank accounts, can generate interest income you're required to report to the irs and pay taxes on. This expense is most common in firms with copious amounts of fixed assets. If you earn more than $1,500 in interest or meet various other requirements, you may have to complete more. When you think of personal financial planning and money management, the first thing that might come to mind is that you'll need to establish a clear budget. The underpayment of taxes is against the l. The income statement reports all the revenues, costs of goods sold and expenses for a firm. The report presents the company's financial standing by showing the comp. Corporate financial reports, also known as annual reports, need to be completed once a year by the company's ceo and the person responsible for the company's finances. One expense reported here relates to depreciation.

Corporate financial reports, also known as annual reports, need to be completed once a year by the company's ceo and the person responsible for the company's finances. A certificate of deposit, like all bank accounts, can generate interest income you're required to report to the irs and pay taxes on. An expense report is a report submitted to a client or employer that details the expenses an employee or contractor has paid while completing a task for the client or employer. An income statement is a profit and loss statement that gives an overview of a company's performance during a particular time or accounting period. Estates and trusts can earn money that gets paid out to beneficiaries.

Afterwards, the employee fills out the expense report to document.

Afterwards, the employee fills out the expense report to document. If the trust has instructions that require the payouts, the beneficiaries must pay the taxes. Workers are frequently given only pieces of information that concern monthly income streams. Expense reports are used to track all of the expenses that should be reimbursed. This expense is most common in firms with copious amounts of fixed assets. In the absence of thes. The income statement reports all the revenues, costs of goods sold and expenses for a firm. A certificate of deposit, like all bank accounts, can generate interest income you're required to report to the irs and pay taxes on. To determine your gross income per month, you can use a calculation, or one of the many free monthly gross income calcultators available online. Otherwise, the trust is on the hook for the taxes. When you think of personal financial planning and money management, the first thing that might come to mind is that you'll need to establish a clear budget. Corporate financial reports, also known as annual reports, need to be completed once a year by the company's ceo and the person responsible for the company's finances. One expense reported here relates to depreciation.

Template For Income And Expense Report For 12 Months. The report presents the company's financial standing by showing the comp. In the absence of thes. It's what serves as a foundation to help you plan for the future by keeping both yo. Estates and trusts can earn money that gets paid out to beneficiaries. If the trust has instructions that require the payouts, the beneficiaries must pay the taxes.

Posting Komentar untuk "Template For Income And Expense Report For 12 Months"